Even if the borrower finds a lender who is willing to refinance his mortgage, the interest rate may be high.ĭeclining House Price - In an environment where house price is declining, the borrower may owe more on their mortgage than the value of his home. Since homeowners are building equity slowly by making minimum payments on their balloon mortgage, lenders may decline their application for refinancing. Harder to Refinance - Lenders may not be willing to refinance a balloon mortgage when the balloon payment is due unless the homeowner has good equity in their house. The house could be foreclosure.īuilding Equity Slowly - With a low monthly payment, homeowners are building equity slowly.

Even worse, if he loses his job, not only he won't be able to afford the large payment, he won't be able to refinance it either. High Risk - If a borrower is counting on a rising income or a bonus from work to afford the large lump sum payment when it comes due, he could lose his home if his salary doesn't rise enough to afford the payment. Large Lump Sum Payment - After the initial low monthly payment is over, borrowers are faced with large lump sum payments to pay off the mortgage at once. A balloon mortgage allows these buyers to buy a house that they cannot otherwise afford.Īs with anything else in life, when something sounds too good to be true, there are drawbacks to a balloon mortgage. With their rising income, they will be able to afford a higher monthly payment after refinancing their mortgage. They can take advantage of the lower monthly payment initially and then refinance before the balloon payment is due.

Rising Income - Borrowers who expect their income to rise sharply in the coming years may consider a balloon mortgage. There is no reason to pay higher fees and higher monthly payments for a traditional mortgage when these borrowers are looking to sell their house in a few years. Planning to Move - A balloon mortgage is useful for homeowners that are planning to move or relocate in a few years. Lower Overall Costs - The costs for financing a balloon mortgage are much lower than a traditional mortgage with a 30-year term because the mortgage is much shorter and borrowers will pay less in interest payments. Lower Monthly Payment - The monthly payment is lower for balloon mortgages because their interest rate is usually lower during the initial period than a fixed-interest mortgage or variable-interest mortgage. There are benefits and disadvantages of getting a balloon mortgage, following are the balloon mortgage pros and cons. However, a balloon mortgage could be risky as the lump sum payment due at the end of the term is a huge amount compared to the regular monthly payments. The homeowners are not looking to stay in the same house for 30 years. The interest rate is usually lower in the initial period compared to a fixed 30-year mortgage making them useful for homeowners who are only planning to stay in their homes for a short period of time.

#Mortgage calculator with amortization chart full#

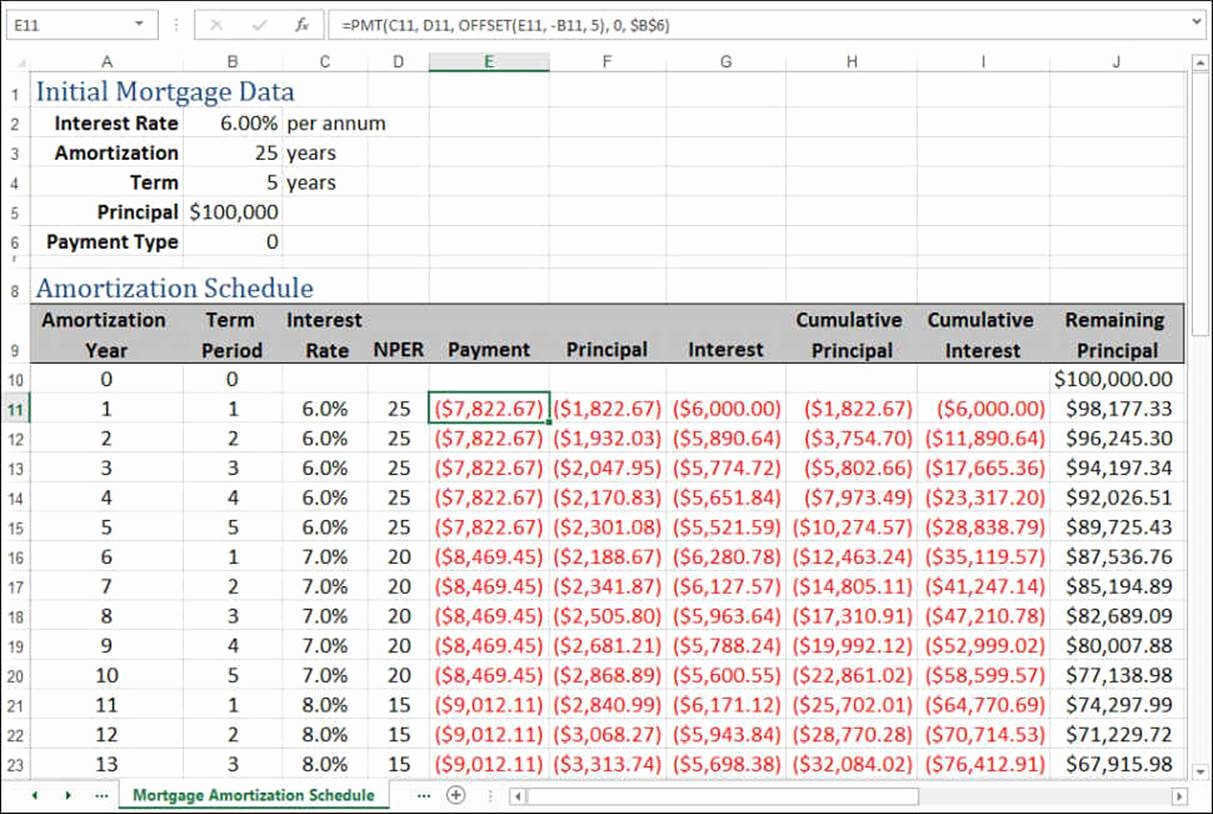

The balloon loan amortization schedule excel is downloadable.Ī balloon mortgage is a mortgage where the borrower is allowed to make low or interest-only payments initially and at the end, he is required to pay off the full balance in a lump sum.īalloon mortgages are usually for short-term borrowers who are expected to pay the lump sum in 5 to 7 years.

Amortization Schedule With Balloon PaymentĪmortization schedule with balloon payment is useful for borrowers who need to calculate short term ballon loans.

0 kommentar(er)

0 kommentar(er)